Trend Analysis |

To begin a trend analysis we must keep a close eye on the changes we can expect from a new currency among BRICS, SCO and nations in the Eurasian Economic Union. This means we can expect the IMF to continue forecasting bleek economic news. Consequently, we have established a unique Business Wave Theory. The theory is heavily influenced by intermarket analysis. This allows us to validate a market trend over time while factoring in the current business cycle. Intermarket trend requires knowledge about the trends of stocks, commodities and currencies.

The business cycle and intermarket analysis are vital for controlling risk management. Thus, our Business Wave Theory generates a tranquil trading platform. It is most useful on mid-term time frames such as a seven year business period. There are times when the theory is clear and other times when it is not.

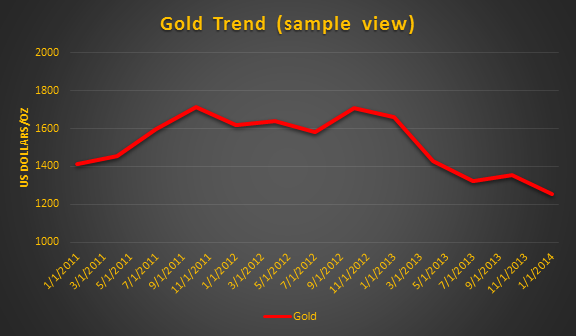

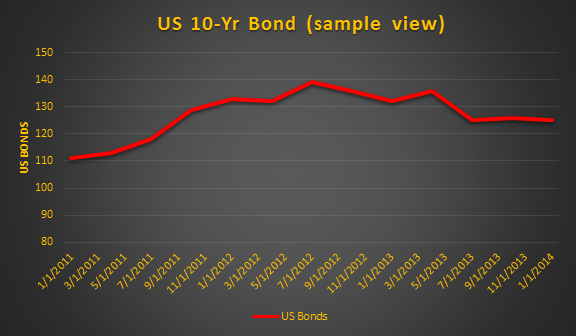

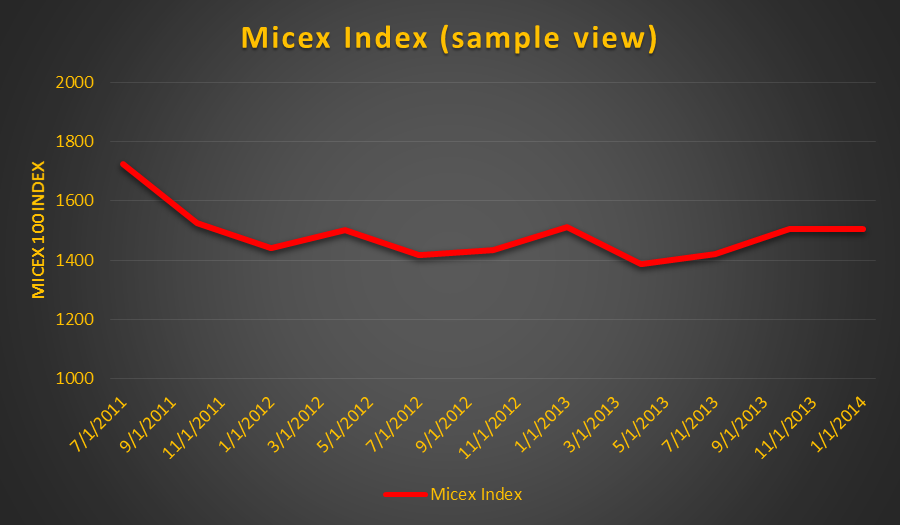

Trying to force unclear market information to acquire or change a trading positions while ignoring other technical tools and market conditions in the process, is a misuse of the theory. The key is to view the Business Wave Theory as a line to market forecasting for validating market trends. Using it in conjunction with all the other technical theories will increase your gains. Here is a sample of trends clearly visible during the height of Western monetary easing policy.

Our Business Wave Theory uses the gold exchange standard to underline inflation roots.

Our Business Wave Theory considers the leading political and economic factors that contribute to changes in trends starting with the currency markets.

Our Business Wave Theory allows users to accurately gauge the trends of major markets for changes.